Fundamental Strategies Needed For Implementing Your Business Niche Through Affiliate Crowdfunding

TABLE OF CONTENTS

1. Introduction ......................................................................................

2. How To Survive At 55 ..........................................................................

3. American Debacle - The Dollar Is Falling ...................................................

4. Roadmap For Fixing Your Credit & Debit Status ..........................................

5. Withdraw Your 401(k) Or IRA Account Savings & Invest In Bitcoin (BTC) ............

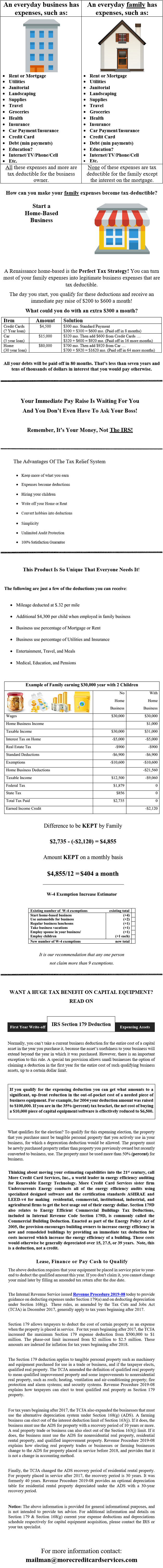

6. Your Social Media Tax Plan Strategy .......................................................

7. Angel Investors Who Love Crowdfunding ..................................................

8. The Cold Hard Truth About Targeted E-Mail Data ........................................

9. Ten (10) Ways To Get Your Emails Noticed & Opened ..................................

10. The Necessity For Having Decentralized Social Media Marketing & Branding .....

11. The Pros & Cons About Social Bookmarking .............................................

12. Blogging All The Way To The Bank ........................................................

13. Ten (10) Things Every Entrepreneur Should Know About Investors .................

14. Conclusion .....................................................................................

Introduction

Dear Friends,

Now I'm in action with some very exciting news, but before I get into that... Let me ask you a question; if there was a way for you to launch your own dream project through Commission Earnings and with Other People's Money (O.P.M.) would you be interested in the following details discussed below?

My name is Tarik C. Richards of More Credit Card Services (MCCS) and would like to present to you a newly launched monetizing strategy and system for the working class, unemployed and small businesses alike looking to acquire capital more efficiently and effectively called Affiliate Crowdfunding. Our firm More Credit Card Services (MCCS) was motivated in its research to developing the most engaging, unique and innovative Crowdfunding Plan & Strategy for our serious affiliate members. Furthermore, our firms Affiliate Crowdfunding Program not only generates capital within itself, but also in the optional Two Separate & Diverse Program Methods for our serious affiliate members called Brick & Mortar Business and Internet Viral Business for earning extra capital.

We at More Credit Card Services (MCCS) are so excited about this affiliate program that we wanted to share with you this FREE informative Online-E-Book containing 13 sections discussing the many benefits our Affiliate Crowdfunding Program brings when you become a lifetime member. By purchasing our Affiliate Crowdfunding E-Book Guide today, you will have the opportunity to become a part of an indispensable affiliate program that uses unique crowdfunding strategies to raise capital that is done by no other.

Almost everyone in the world are looking for ways to acquire capital to start their businesses, dream projects or ventures by networking with many Angel Investors and Venture Capitalist to provide this opportunity or the Stock Market. Many individuals also use Mainstream Crowdfunding Platforms, such as GoFundMe, Kickstarter, Indiegogo, Patreon and much more to raise capital on the internet. Some other common examples an individual needs to acquire capital for include:

- Rent

- Education

- Health Insurance

- Real-Estate Investing

- Natural Disaster Recovery

- Home Ownership

- Renewable Energy Investing

- Car Insurance

- Bailout

- Bitcoin Investing

- And Much More......

So as you can see, acquiring capital is an integral part of our daily lives for success. Because acquiring capital is so important, I wanted to strategize for an efficient and practical way through affiliate marketing to find serious prospects that are interested in working together in unity to raise capital by using low investments for supporting each other's personal endeavors on a continual bases that works for all members associated with our Affiliate Crowdfunding Program which results to Zero Financial Risk.

The information discussed in our Affiliate Crowdfunding E-Book Guide is so important that you will no longer use the Stock Market, Angel Investors, Venture Capitalist, and many other types of Mainstream Crowdfunding Platforms to raise capital.

Another motivation towards launching this Affiliate Crowdfunding Program is to implement working solutions for preventing individuals from having to:

- REPAY THE MONEY

- PAY INTEREST

- GIVE UP EQUITY OR DEBT PLACEMENT FOR TANGIBLE OR MONETARY REWARDS IN YOUR COMPANY

- SHOW YOUR BUSINESS PLAN

- PAY PERCENT FEES

- BE LOCKED INTO DEADLINES ON RAISING CAPITAL FOR YOUR PROJECTS, as commonly associated with many of the risky attributes of Angel Investors, Venture Capitalist and Mainstream Crowdfunding Platforms.

- BECOME A VICTIM OF PREDATORY LENDING PRACTICES, as commonly associated with many Major Banks and Check Cashing Facilities using bait techniques to LOAN SHARK consumers with PAYDAY LOANS .

- BECOME AN ACTIVE PARTICIPANT AND EVENTUAL VICTIM WITHIN ILLEGAL PYRAMID OR PONZI SCHEME FUNDING PROGRAMS

- AND MUCH MORE......

As a result of this launch, we want to educate you on how to implement your business niche through our marketing strategies for the purposes of Affilate Crowdfunding success. So More Credit Card Services (MCCS) purpose and focus is to serve individuals including entities such as the working class, unemployed, startups and small businesses globally where we can help them achieve their goals and objectives towards having successful entrepreneurship by giving them the effective tools (products and services) they need to improve their wealth by way of networking and group support.

Hence, our Affiliate Crowdfunding Program was structured to be perfectly suited for the aforementioned individuals & entities looking to get additional financial support through earned commissions and to teach them group economics for the purposes of earning extra capital with the sponsors they refer. Furthermore, this affiliate program can solve the issue concerning low wage work and other financial issues plaguing our society today.

General Details & Benefits:

- Earn 50% commissions for every referral purchase of our E-Book Guide!

- Learn how to become a successful affiliate marketer!

- Learn how to build an organization from the serious prospects you refer and earn extra capital!

- Learn about the important software tools that protect your privacy & security when doing business online!

- Learn about the Algorithm System Network and how it directs our affiliate members towards Same-Level-Marketing!

- Learn how to purchase and invest in Bitcoin (BTC) more effectively to fund your personal endeavors!

- Receive our Affiliate Tools Package when becoming a member!

- 24/7 support through our Affiliate Crowdfunding Program!

So if you are one of many individuals looking to start your own small business or just need help acquiring capital to get through the tough times within a capitalistic system, we provide all the necessary tools to satisfy your needs.

- That would be a pretty cool place to be wouldn't it!

- Think about the benefits it will bring for you and your family!

After you have read and studied our Affiliate Crowdfunding E-Book Guide, you will realize how powerful our Affiliate Crowdfunding Program is to help you raise capital within any niche market sector. When you discover the many valuable secrets for how to utilize our Affiliate Crowdfunding Program to raise the capital needed for whatever your personal endeavors are, it will drastically change your life!

People are currently using our Affiliate Crowdfunding Program to launch their own ideas, projects, pay for marketing campaigns, further their education with college tuition, and even pay for their personal activates....So Can You!

Requirements Needed To Become A Lifetime Affiliate Member:

- You must first sign-up for a FREE ProtonMail Account [click-here].

- Next use your ProtonMail E-mail to register for an MCCS Account [click-here].

- Then purchase our Affiliate Crowdfunding E-Book Guide for a one-time cost from $50.00--$52.00 either directly from this Online-E-Book using PayPal or through our website [click-here] by sending us a USPS Money Order or Bitcoin (BTC).

If you are a small business looking to acquire more advice for improvement on where you stand as a business or need to get access to more capital, take our self-diagnostic test under the section called [About-Business] and join our Affiliate Crowdfunding Program. No matter what your situation is to acquire the capital funding you need for your personal endeavors, our Affiliate Crowdfunding Program can help GUARANTEE SUCCESS!

Check out some of our common categorical niche market sectors:

|

Arts & Humanities |

Contests |

|

Newsletters |

Promotion |

|

Entertainment & Leisure |

Education & Reference |

|

Autos, Boats & Plane |

Auction |

|

Pets |

Personal Web Pages |

|

Brewery & Restaurant |

Games & Fun |

|

Money & Finance |

Money & Finance |

|

Shopping & Services |

General Content Makers |

|

Business & Consulting |

Retail Consumer Goods |

|

Healthcare & Fitness |

Business Opportunities & M*L*M |

|

Science & Technology |

Hobbies & Interests |

|

Children's Daycare |

Society & Issues |

|

Home & Garden |

Sports Technology |

|

Fashion Design |

Clubs & Organizations |

|

Life & Family Issues |

Computers & Software Magazines |

|

Renewable Energy Technology |

Movies & Television |

|

Telecommunications |

Web Hosting & Technology |

|

Mobile Apps |

IOTS (internet of things) |

|

Travel |

Advertising & Design |

Everything you make above and beyond that goes towards building your wealth and legacy contributes to a sound growing worldwide economy. Subsequently, we out-perform all other crowdfunding firms as shown within the following table below. Plus after you have read and studied this informative FREE Online-E-Book Guide and you decide to become a lifetime member in our Affiliate Crowdfunding Program, you can contrast our performance against all other crowdfunding platforms by reviewing the list below.

To Study & Learn About The Details Of Our Affiliate Crowdfunding Program's Important Plan & Strategy, Purchase Our E-Book Guide Today By Clicking On The 3D Image Below To Make A PayPal Transaction:

In order to obtain Bitcoin (BTC) from More Credit Card Services (MCCS), you must follow the detailed instructions inside our Affiliate Crowdfunding E-Book Guide, and then come back to this Online E-Book Guide to click-on the Bitcoin Icon shown below:

If you decide to purchase our E-Book Guide via PayPal, be sure to [click-here] and register for an MCCS Account so we can add you in as a lifetime affiliate member!

========================================================

========================================================

How To Survive At 55

IF YOU ARE 55 AND HAVE NO FUNDS FOR RETIREMENT, PLEASE READ THIS!

What if you are homeless this means to some degree you are destitute with no money, no place to go and without any hope or vision. When you are homeless its difficult to get a job, a bank account, life & health insurance, a debit card and showing good credit for just about everything you need. The COVID-19 Pandemic has even more so exacerbated and exposed many telltale situations.

Sometimes sleeping in parks and on benches and in cars, vans or trucks that do not run, feeling the heat, feeling the cold and sometimes the rain with the wind blowing during the day or night concerned for your safety while sleeping on concrete and asphalt contained inside doorways and alleys.

You may also feel itchy, smelly and tired because you are unclean, hungry and lonely without any friends that know or care about your conditions. You may want to see a doctor for health issues or conditions you may have, but you are afraid of the diagnosis and the resulting cost.

Sometimes you may think about when and if you had them, what family and friends would say about your life style now that you are sleeping outdoors in the streets. You may be ashamed and feeling sorry for yourself, thinking that you have hit rock bottom.

May be you have come to yourself and said "is my condition a result of my own actions or inactions"? Then you began to think logically and practically and then realize that some things occur because of life's circumstances and you are not completely at fault.

- Do you know someone that is experiencing the same or similar condition you're in?

Assuming this is the case, talk to that individual about your dreams, wishes, goals and objectives for your future. Tell them honestly about your limitation and negative habits to get a clearer picture of yourself.

You may recall what the Good Book said, "my people suffer for lack of knowledge", found in Hosea 4:6 King James Version (KJV) which states specifically:

My people are destroyed for lack of knowledge: because thou hast rejected knowledge, I will also reject thee, that thou shalt be no priest to me: seeing thou hast forgotten the law of thy God, I will also forget thy children.

You may recall that God The Father said, "his mercy is on whom he will", found in Romans 9:15-18 King James Version (KJV) which means both saint and sinner for a time will receive God’s blessing. Why? Because the saints will grow in grace and the sinners will unknowingly glorify God. Therefore it rains on the just as well as the unjust.

You may recall Lazarus the poor man that waited at the rich man's gate for food and water found in Luke 16:19-31 King James Version (KJV). This scripture says nothing about his inability to work, but states, he did nothing for his needs but had faith in God; and as a result, he was caught up into the bosom of Abraham! However, God does not want us to follow this example of non-works! For example, Methuselah lived almost a thousand years and accomplished nothing at all. The Bible records of him that, he was born, he lived and he died, found in Genesis 5:24-30 King James Version (KJV).

You may recall that Job was a righteous man serving God in spirit and in truth with great patience found in Job 1:1 King James Version (KJV). Furthermore, Job's fatal question was, "why has all of these problems happened to me"? Since I have completely loved, obeyed, trusted and followed God, I should be exempt! The sinner will suffer for his ungodly deeds, but when the saints suffer, it is unto building immutable character, patience, experience and hope; Romans 5:1-4 King James Version (KJV).

Lastly, you may recall the Prodigal Son that sinned but came to himself and repented, due to the realization of his suffering. The culture at that time was for the eldest son to provide provision for the entire family at the sickness or death of the father. Nevertheless, the Prodigal Son wanted to change the norm and his father refused him not for peace sake! Because of his dissimilation, he had to now humble himself to circumvent his hunger and thirst wherein his father rejoiced and forgave his son for lack of understanding, found in Luke 15:1-32 King James Version (KJV).

When you think about your circumstances using the resources you already have weather tangible or intangible, you have an asset in yourself and others. Remember, God said to us, "I came that you might have life and have it more abundantly". The manifestation of this is when God wakes you up each morning to begin your productive activities, found in John 10:10-12 King James Version (KJV). Now, the specific rule to follow in business is asking, searching and finding your needs by way of the tangible or intangible resources you have. Think about it, the first and most important thing you need is a home which is the foundation of all progressive and successful methods of entrepreneurship for creating equity and cash flow; Matthew 7:7-12 King James Version (KJV). You cannot get bored or lost in this strategy because it is a step-by-step repetitive process for building all the information you acquire and need to be successful at gaining more resources.

You are thinking I am homeless, dirty and lack confidence. How is such a thing possible? Think about the things you have heard of and seen, you can find a place to take a shower and get a new change of clothing and something to eat. Remember, don't be afraid of being turned down when you make a request. The justification of your actions is to continue Matthews's process for success no matter what! Furthermore, make sure you always use the power word Thank You, and if you are a fellow Christian, make sure to mention and say God Bless You! If you truly mean what you say, your words are true and faithful.

Think of the things you can get freely and of things that are given away, your thoughts are your intangible resource and they can be manifested in tangible values. A timely plan and schedule, including the places you need to go for gaining knowledge are the benefits of the day. Keep the names and numbers of people you meet good or bad; they can be added as a resource and then become an asset. If you don't have a mobile cell phone and/or a notebook computer, there are places you can make productive use of these items for free. Be sure to sign-up for a Proton Mail Account which is secure and private.

Do not worry about the bad economy because as long as there are people, there will always be a need for economic exchange for products and services using physical or virtual currency. The future currency will be Bitcoin (BTC) as the dollar continues to drop in value. Based on your God given talents, experience and skills, you can definitely make a prerequisite decision towards Real Estate Investing and Home Ownership with no money down and/or using other people's money. As we stated before, home ownership is the foundation of stable equity and cash flow in an unstable market.

Using any type of free public resources during the COVID-19 Pandemic presents some major challenges, but can be of a great benefit if you would teach yourself how they work and function. Entities like The City, The County, The Patent Office, The Law Libraries including The Employment Centers can help you greatly with locating data or research information you are looking for to create an easy path to your financial success; but first you must call to see when these offices are open. The Federal and State can also provide you with resources compatible with your goals and objectives. For example, searching for unclaimed assets that could be yours. This is just the tip of the iceberg with the State and Federal economy self-help programs.

There are a multitude of opportunities flowing around no matter what negative things our negligent Elected Officials and Police are doing when they circumvent and break the law to keep you at bay! Many of those opportunities come from your own ideas and concepts. Remember how creative and artistic you can be! For example, when Corporate America came to visit our local and poor communities claiming to fund it, they instead came for opportunities to get ideas, concepts and innovations from the poor, unemployed and working class people; and the next thing you see is the very products and services we developed mentally or physically in their stores. So remember to search out your abilities and see how far they can take your transferrable skills to any kind of business.

If you are a Disabled Veteran (DVBE) and have had problems and challenges with the Department Of Veteran Affairs, you can approach them on issues of home ownership using our Affiliate Crowdfunding Program to aid and help other homeless disable veterans through networking. One disable veteran can education five (5) others which can turn into seven hundred and eighty (780) people. Through seeking home ownership, you can also renew your profession or trade towards multiple sources of income while helping others do the same for your own income viability and security.

Now that we have some degree of direction, our first goal and objective should be towards looking for property with no money down! Check first by [clicking-here] to make sure your personal credit rating is good even though you are not looking for a loan, and in general you cannot get one anyway. Your first thoughts should be finding someone that already owns property under the right conditions for take over ownership. So if you don't know of anyone, you must start looking as in many different ways possible. With a pen and paper, you can advertise all over the neighborhood to find what you're looking for!

While you are focusing on our Affiliate Crowdfunding Program and finding some indirect income through many other situations, it is critical that you save up to $52.00 dollars for our program and sign-up for a ProtonMail Account, as this is important for your privacy and security. This program will pay you back for this one-time initial investment by way of referring others (serious prospects). Now our first investigation will be to find properties under a reverse mortgage loan or seller motivated properties; this means someone is in financial difficulty and will better understand your plight and conditions.

When working to get information from any Federal, State and Local Agencies, it can be challenging sometimes, and in general I don’t fully trust these public agencies; so don’t give pertinent data to them. Make sure your information to them is on a need to know bases. Write down what you want to present before you approach them. This will protect you from having your good ideas and concepts taken. So privacy and secrecy is always preeminent in all of your plans and strategies. Keep your directives as plain and as simple as you possibly can, with a focus on data collection and research!

Now remember, you don’t have to be a disabled veteran to gain the same benefits within our Affiliate Crowdfunding Program. Therefore, you are looking at how to buy a Duplex, Triplex, or Fourplex under as many programs as you can discover and implement them according to your abilities and skills. Let us start out by looking at and focusing on homes under a reverse mortgage loan or seller motivated properties with regards to regulation established by the Internal Revenue Service (IRS) for Capital Gains Tax Deferment Options on multi-family residence as opposed to single family homes and how to invest in Real Estate without a Bank.

Also for those who are grant writers, there is this Notice of Funding Availability (NOFA) which establishes the funding criteria for the FY 2020 and recurring years, a Continuum of Care (CoC) Program. The U.S. Department of Housing and Urban Development (HUD) and the Community Development Financial Institutions Fund (CDFI) is making available approximately $8.1 billion in Fiscal Year 2020 for the CoC Program. The CoC Program is designed to promote a community-wide commitment to the goal of ending homelessness by way of providing a funding source through the efforts of nonprofit providers, states, and local governments so they can quickly re-house homeless individuals, families, persons fleeing domestic violence, and the younger generation while simultaneously minimizing any kind of trauma and dislocation caused by homelessness; to promote access towards an effective utilization of mainstream programs by homeless individuals and families; and to optimize self-sufficiency among those experiencing homelessness. And lastly, please review and study the TABLE OF CONTENTS of this FREE Online-E-Book Guide under section five (5) entitled "Your Social Media Tax Plan Strategy" on Reverse Mortgage.

Supporting Reference Information For This Section:

- Life Without Retirement Savings: [click-here].

- Black Seniors Losing Homes Because Of Reverse Mortgages: [click-here].

- State & Federal Public Resources:. 1.[click-here].. 2.[click-here].. 3.[click-here].

- How to Buy a Duplex, Triplex, or Fourplex – The Ultimate Guide: [click-here].

- We Buy Homes 4 Cash: [click-here].

- Veterans Housing & Homelessness Prevention Program (VHHP): [click-here].

To Study & Learn About The Details Of Our Affiliate Crowdfunding Program's Important Plan & Strategy, Purchase Our E-Book Guide Today By Clicking On The 3D Image Below To Make A PayPal Transaction:

In order to obtain Bitcoin (BTC) from More Credit Card Services (MCCS), you must follow the detailed instructions inside our Affiliate Crowdfunding E-Book Guide, and then come back to this Online E-Book Guide to click-on the Bitcoin Icon shown below:

If you decide to purchase our E-Book Guide via PayPal, be sure to [click-here] and register for an MCCS Account so we can add you in as a lifetime affiliate member!

========================================================

========================================================

American Debacle - The Dollar Is Falling

GET READY AMERICA, THE DOLLAR IS COLLAPSING!

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Characteristics central to capitalism include private property, capital accumulation, wage labor, voluntary exchange, a price system and competitive markets. Within a capitalist market economy, decision-making and investments are determined by every owner of wealth, property or production ability in financial and capital markets, whereas prices and the distribution of goods and services are mainly determined by competition in goods and services markets. Economists, political economists, sociologists and historians have adopted different perspectives in their analyses of capitalism and have recognized various forms of it in practice. These include laissez-faire or free-market capitalism, welfare capitalism and state capitalism.

Market Saturation of Non-Perishable Goods and Market Extraction of Perishable Goods leads towards a collapse in the supply and demand chain of the United States Economy. This means if your income exceeds your outgo then your upkeep will be your downfall –– (i.e. also known as the capitalistic system).

Already, millions of American citizens are calling for the United States Government to take action on "fixing our economic inequalities".

The calls for higher tax rates on the wealthy are just the tip of the iceberg.

Here’s what’s coming next...

More Credit Card Services (MCCS) says the bigger step, which has been mentioned and endorsed by many of the most powerful people in Washington, is to "clean the slate"... to wipe out debts and "reset" the financial system.

The crowds are cheering for this message like never before. The violence and protest will escalate. Our politicians are now promising this reset of the financial system as a way to a "new and better prosperity", but do the politicians ever keep their promises?

And while it might sound like good news to those who have gotten in over their head –– what will really happen, says More Credit Card Services (MCCS), is a national nightmare.

You see, this idea of erasing debts to reset the financial system is not new. In fact, in the Bible, it's referred to as a "Jubilee".

If you're unfamiliar with the term, it comes from "The Old Testament" located inside the book of Leviticus, Chapter 25:1-55 King James Version (KJV).

A jubilee in the Jewish tradition was to occur roughly every 50 years.

It was a time for total forgiveness of debt, the freeing of slaves after they had left Egypt, and the returning of lands. Moses, a Levi, proclaimed the first Christian Jubilee by the will of God after He led his people out of Egypt.

And according to More Credit Card Services (MCCS), since then, it's been used dozens of times, when anger among a population hits extreme levels, typically because of an explosive divide between the wealthy and the working class known as income inequity.

Now, millions are calling for a new economic system here in America… something other than capitalism.

Individuals such as Richard David Wolff a Marxian Economist from Yale, Bill Black a White Collar Criminologist, Carmen Reinhart of Harvard University and Stephen Roach of Yale have advocated for a fix of the economic system in one form or another. So have financial pundits Barry Ritholtz and Chris Whalen.

In Congress, more than a half-dozen jubilee-style laws have been proposed, by folks such as Rep. Kathy Castor and Senator Bill Nelson from Florida.

And many of the most powerful left-wing economic "experts" are calling for a fix of the economic system by name, since we have just started to define and talk about the negatives of capitalism while not engaging each other on better economic systems.

London School of Economics Professor David Graeber says: "we are long overdue for some kind of Biblical-style Jubilee... it would relieve so much genuine human suffering."

The citizens of the United States and its majority says we should: "Think Jubilee, but not American Style... because the Christian Jubilee combines a sense of social justice with old-fashioned common sense."

Paul Kedrosky, a senior fellow at the Kaufman Foundation (a liberal think tank), mentions that: (we need a fresh start, and we need it now because of the failure of the Federal Reserve.). This would be a new Jubilee.

According to the Corbett Report, their documentary entitled "Century of Enslavement: The History of The Federal Reserve" from 1913 shows their continued failure from the Great Depression around 1932 until the Recession of 2008.

URL Reference Source: [click-here]

As a Slate Magazine reporter recently wrote:

Come 2020, at least one major Democratic candidate for president is going to campaign on outright canceling a boatload of student debt.

You see, today, for millions of Americans, there's no more powerful political promise than a Debt Jubilee. Politicians will soon be promising it all...

- I will wipe out your debts!

- I will allow you to start fresh!

- I will reward all of your bad decisions!

- I will solve America's massive income inequality!

Who will pay for it?

More Credit Card Services (MCCS) says there's only one option:

You, me, and millions of other Americans with pensions, retirement accounts, and other types of savings.

Just as in the past, More Credit Card Services (MCCS) says the folks in Washington will disguise this Jubilee under a different name.

They might call it a "National Restoration" or "Patriotic Solvency".

They'll pass an "Act" like they did in 1841... or invoke an Executive Order as was done in 1933 (Executive Order #6102)... or simply issue or release a mandate to the Secretary of the Treasury (which they did in 1971).

But they would make you think it all means the same thing, not so! The Jubilee will redistribute hundreds of billions of dollars from those who have invested and saved... to those who can no longer pay their debts.

So what does a Jubilee look like in the real world... how will it unfold in America... and what will it mean for you, your money, and your retirement?

Well, that's why More Credit Card Services (MCCS) and their team, who have done more work on this subject than anyone else in the financial industry—and have just finished what could become the most important book in America over the next few years.

More Credit Card Services (MCCS) says that what's coming next in our country will be a lot worse than the tech crash. It will be a lot worse than the mortgage crisis too. And he says no matter how sound your financial footing, this is the most important issue facing you and your money today.

That's why we put together our brand-new book entitled "Affiliate Crowdfunding: A Guide To Joint Venture Capitalization". It is a compilation of our firm's best research and recommendations on this subject—and it's not available in any bookstore.

This book explains in great detail how fix financial issues for the poor, unemployed and working class. It explains how capital is generated for all affiliate members who purchase this guide.

And most importantly, it explains everything you need to know and what to do to prepare for the first Jubilee in our country that MUST COME if the United States is to have a future.

What Will This Jubilee Mean For You And Your Family?

What's interesting is, around the world today, the idea of a Jubilee has become the de facto solution for extreme financial problems... when debts can't be repaid.

Iceland used a Jubilee to restructure mortgages that were underwater. Croatia used a Jubilee in 2015 to wipe out millions in consumer debt. Japan is doing the same right now with nearly half its national debt. This is akin to U.S. bankruptcy laws that protects the debtor from the creditor, which assumes the laws for products and services the debtor can no longer pay.

The idea of a Debt Jubilee has become the de facto solution when debts can't be paid. After studying hundreds of years of financial history, More Credit Card Services (MCCS) says America's upcoming Jubilee will strongly resemble the one that took place in our country way back in 1841, but for a select group of people, mostly white males...

Back then, the laws were temporarily changed, so debtors could be discharged of their debts... without the consent of the creditors. Over a period of 13 months... more than 40,000 people wiped away their debts before the act was rescinded.

But of course, this time around, according to More Credit Card Services (MCCS), the Jubilee won't be tens of thousands of people like it was in 1841... it will instead be tens of millions of people, and trillions of dollars.

Now, if you do not think a Debt Jubilee is possible here in the United States of America, More Credit Card Services (MCCS) says you haven't studied U.S. history... and you aren't paying attention to the current political climate...

And when you look at the staggering figures behind student loans alone, you can see why...

And when you look at the staggering figures behind student loans alone, you can see why...

Over the past ten years, students (most of whom are young and have virtually no income) have racked up enormous debts, which currently total about $1.5 trillion.

Incredibly, that's what our entire federal government owed a little more than 30 years ago.

And these debts have ballooned to absurd amounts. The number of students with debts over $100,000 has quadrupled in the last ten years. More Credit Card Services (MCCS) says most of this money will never, ever be repaid.

And most Americans don't realize that the Millennials (who hold nearly 65% of this debt) are now our country's largest generation, outnumbering Baby Boomers.

Just think about the political implications...

These people have an enormous stake in whether or not a national Debt Jubilee is declared.

As More Credit Card Services (MCCS) explains in their book: When the rich—a very small percentage of the population—get in trouble with debt, it's an economic problem for the poor, unemployed and working class.

And there will be major consequences...

According to More Credit Card Services (MCCS), millions of investors, pensioners, insurance customers, and creditors will lose a fortune.

Stocks will collapse. Dozens of companies will go bankrupt.

In fact, More Credit Card Services (MCCS) gives one quick example of how this problem will affect EVERYONE in America...

Do you remember during the last crisis... the mortgage crisis... how many lenders never bothered to verify the income of people they were lending money to?

Some referred to these as "Liar Loans", which allowed borrowers to make up whatever income figure they wanted... and get a much more expensive house than they could realistically afford.

Well... believe it or not, the same thing is happening again right now with auto loans.

One company More Credit Card Services (MCCS) has written about more than a dozen times has made an extraordinary number of these "Liar Loans" for cars. And a recent Bloomberg story says this firm verified the income on only 8% of the loans they made!

And guess what...

Just like the mortgage crisis of 2008, these loans have been packaged up into what are known as "Asset Backed Securities", and sold to hundreds of mutual funds, insurance companies, investment firms, even state pension plans.

When the Debt Jubilee arrives, More Credit Card Services (MCCS) says the problems with all this bad consumer debt will hit at once.

Everyone will freak out.

And that's the biggest problem, says More Credit Card Services (MCCS)—the uncertainty.

No one will know for months how it will all get sorted out. So the markets will react violently.

More Credit Card Services (MCCS) shows an example of how it could play out.

One proposed scenario, for example, comes from Rob Johnson, a former banker, who now runs the Institute of New Economic Thinking. He says:

You call a month-long bank holiday for the twenty largest banks, and that holds everything in place while the regulators mark down the assets and see how everybody's losses will affect everyone else.

Then you wipe out stockholders, wipe out management, possibly some of the unsecured debt... Once everybody has taken their hit and you've wiped out existing stockholders, then the government comes in and properly, transparently recapitalizes all of them. As these new institutions gain a footing, eventually they can be sold back to the private market.

No one can know exactly how it will be done, but through one mechanism or another, the government will seek to reset the financial system... and they will start by wiping out trillions of dollars in bad debt.

Car companies, homebuilders, credit card companies, insurance firms, banks, other lending institutions, and any business operating with leverage, will take a huge hit.

Stocks will fall considerably. Banks will close. There will be hundreds of billions in losses.

In fact, at the end of the day, More Credit Card Services (MCCS) believes the losses at an institution like Wells Fargo could be enough to start a bank run.

Furthermore, big pharma organizations will lose capital on a global scale due to the coronavirus epidemic and other health issues.

And this brings us to...

What Can You Do To Prepare?

In More Credit Card Services (MCCS) fantastic new book, Affiliate Crowdfunding, you'll learn everything you need to know to prepare for this tumultuous time...

First, you'll get the ultimate guide to understanding EVERYTHING YOU DO NOT want to own as America's Jubilee unfolds.

This is important, because More Credit Card Services (MCCS) says there will be huge losses.

More Credit Card Services (MCCS) points to a Harvard study showing how during a Debt Jubilee in the 1930s, the U.S. government's radical changes in the financial system took more than $700 million in a single year from one segment of the population. Another change caused millions of Americans to lose 69% of their savings, practically overnight.

If our U.S Government can implement debt solutions such as the Croatian government did back in 2015 by using a Jubilee to erase more than $20 million in debts for 60,000 people, it would also work here in America. This was money owed to banks, telecom operators, municipal authorities, and utility companies, but the Croation government put their citizens first because they are the resource to equitable productivity, paid for by an unregulated currency called Bitcoin (BTC).

Apparently, not a single person or investor was refunded for their losses.

And it's probably no surprise that the stock market went down significantly over the next year because of the uncertainty in where to invest the prime currency (i.e. the petro dollar).

According to the Croatian Stock Index reported from Jan 2015 – Jan 2016, keep in mind concerning the money that More Credit Card Services (MCCS) predicts will be written off in America's upcoming Jubilee will likely be 100,000-times higher than what we saw in Croatia (around $3 trillion compared to $20 million).

In order to understand or interpret the meaning of the Jubilee we need to define the terms that will allow us to compare scripture with scripture. For example, the key idea behind redemption is how an individual, group or organization maintains itself after letting assets or resources go back to the original owner!

Hosea 4:6 King James Version (KJV) states:

You call a month-long bank holiday for the twenty largest banks, and that holds everything in place while the regulators mark down the assets and see how everybody's losses will affect everyone else.

2 Chronicles 7:14 King James Version (KJV) states:

If my people, which are called by my name, shall humble themselves, and pray, and seek my face, and turn from their wicked ways; then will I hear from heaven, and will forgive their sin, and will heal their land.

Philemon 1:1-25 King James Version (KJV) explains that a slave named Omesimus had ran away from his master called Philemon somewhere in Colosse or possibly in Laodicea. Omesimus found his way to Paul in Rome, where he was converted and persuaded to go back to his master. Paul wrote this letter to request his friend Philemon to receive omesimus as a brother in Christ. Paul’s associate, Tyhicus, escorted Omesimus (Colossians 4:7-9) and delivered the letter to Philemon. The general lesson of Philemon is that our unity in Christ must be more important to us than our earthly relationships, and shows that God hates slavery.

THE APPLICATION OF THE JUBILEE AS IT PERTAINS UNTO BOAZ:

This is a short account of an incident during the period of the Judges. An Israelite family moved from Judah to the land of Moab during a famine. The husband died, the two sons married foreign women, both sons died, the mother (Naomi) returned to her home town of Bethlehem. One of her daughter-in-law (Ruth) accompanied Naomi, adopting Israelite faith as her own. Ruth married again, this time to Boaz, a wealthy Israelite, and become the great grandmother of King David.

Besides showing intimate details of life in those times, the book of Ruth demonstrates how a foreigner was absorbed into Israelite life and history, thus prefiguring the Christian Gospel while at that time keeping the Mosiac Law at it related to the jubilee by which Gentiles in time to come are added into God’s Church. Ruth is a Gentile (Moabitess) in the ancestry of Jesus Christ. It is surprising that Ruth came from the children of Jews by the drunkenness of Lot the nephew of Abraham. His daughters had children by their own biological father the first nation was Moab and the second nation was Ammon. This shows the grace and mercy of God to include such an abominable people into the historical lineage of Christ Jesus. Reference: Genesis 19:34-38 KJV

Definition For Atonement: Reparations for satisfaction and reciprocity.

Definition For Hallow:

To make holy or set apart for holy use or to give something great importance and respect.

Definition For Jubilee:

The jubilee is a monetary system that begins with bartering from an agricultural standpoint moving towards a cooperative system of monetizing products and services using currency.

Definition For Levite:

The tribe that is the spiritual leaders which is the third oldest son of Jacob and first ordained by God for Moses and Aaron leadership.

Definition For Redeem: To discharge, restore, or fulfill (a pledge, promise, etc.).

Definition For Strangers and Sojourners:

Individuals who are Gentiles and are also called or referred to as the mixed-multitude, bondservants and heathens.

Definition For Victuals: Food; sustenance.

Definition For Wax or Waxen: To become or becomes.

Leviticus 25:1-55 King James Version (KJV) states:

1 AND THE LORD spake unto Moses in mount Sinai, saying,

2 Speak unto the children of Israel, and say unto them, When ye come into the land which I give you, then shall the land keep a sabbath unto the LORD.

Reference: Leviticus 26:34-35; Exodus 23:10 KJV

Explanation (v.1-2): Moses is directed by God to inform the Jewish Community that they have a resource in skills, talents and knowhow and materials that they had previously received before they left out of Egypt. The day of worship would be on Saturday.

3 Six years thou shalt sow thy field, and six years thou shalt prune thy vineyard, and gather in the fruit thereof;

4 But in the seventh year shall be a sabbath of rest unto the land, a sabbath for the LORD: thou shalt neither sow thy field, nor prune thy vineyard.

5 That which groweth of its own accord of thy harvest thou shalt not reap, neither gather the grapes of thy vine undressed: for it is a year of rest unto the land.

Reference: 2 Kings 19:29 KJV

6 And the sabbath of the land shall be meat for you; for thee, and for thy servant, and for thy maid, and for thy hired servant, and for thy stranger that sojourneth with thee,

7 And for thy cattle, and for the beast that are in thy land, shall all the increase thereof be meat.

Explanation (v.3-7): The Jewish Community can now take advantage of the resources they have and increase them to a greater degree and as a result do not have to deplete the land of its mineral resources allowing the property to replenish itself in the year of non-growth.

8 And thou shalt number seven sabbaths of years unto thee, seven times seven years; and the space of the seven sabbaths of years shall be unto thee forty and nine years.

9 Then shalt thou cause the trumpet of the jubilee to sound on the tenth day of the seventh month, in the day of atonement shall ye make the trumpet sound throughout all your land. Reference: Leviticus 23:24-27 KJV

10 And ye shall hallow the fiftieth year, and proclaim liberty throughout all the land unto all the inhabitants thereof: it shall be a jubilee unto you; and ye shall return every man unto his possession, and ye shall return every man unto his family.

Reference: Isaiah 61:2, 63:4 KJV

11 A jubilee shall that fiftieth year be unto you: ye shall not sow, neither reap that which groweth of itself in it, nor gather the grapes in it of thy vine undressed.

12 For it is the jubilee; it shall be holy unto you: ye shall eat the increase thereof out of the field.

13 In the year of this jubilee ye shall return every man unto his possession.

Explanation (v.8-13): Moses by the will of God has directed the Jewish Community to establish a schedule that they will remember throughout their generations for the purpose of managing the mega-fold increase of their products and services that is more than sufficient to supply all of their needs and wants. Unlike capitalism, this methodology is sustainable. God gave the Jewish Community a new month named "Abib" which on our calendar year is "April". Therefore, that seventh month would be "Ethanim" which is "October" on our calendar year.

14 And if thou sell ought unto thy neighbour, or buyest ought of thy neighbour's hand, ye shall not oppress one another:

Explanation (v.14): During the jubilee period when the Jewish Community buys and sells from one another this is a time to monetize the cost of products and services thereby establishing some form of currency that can equalize the exchange of items due to bartering.

15 According to the number of years after the jubilee thou shalt buy of thy neighbour, and according unto the number of years of the fruits he shall sell unto thee:

Reference: Leviticus 27:18 KJV

16 According to the multitude of years thou shalt increase the price thereof, and according to the fewness of years thou shalt diminish the price of it: for according to the number of the years of the fruits doth he sell unto thee.

17 Ye shall not therefore oppress one another; but thou shalt fear thy God: for I am the LORD your God.

Explanation (v.15-17): After the jubilee period ends, a new cycle begins counting seven sabbaths of years unto the Jewish Community, seven times seven years. This will keep a record for tracking the supply and demand to manage the usage of goods and services.

18 Wherefore ye shall do my statutes, and keep my judgments, and do them; and ye shall dwell in the land in safety.

19 And the land shall yield her fruit, and ye shall eat your fill, and dwell therein in safety.

Reference: Leviticus 26:5; Ezekiel 34:25 KJV

20 And if ye shall say, What shall we eat the seventh year? behold, we shall not sow, nor gather in our increase:

21 Then I will command my blessing upon you in the sixth year, and it shall bring forth fruit for three years.

22 And ye shall sow the eighth year, and eat yet of old fruit until the ninth year; until her fruits come in ye shall eat of the old store. Reference: 2 Kings 19:29 KJV

Explanation (v.18-22): It is important that the Jewish Community stay obedient to the word of God given by Moses as the Elected Official or Magistrate. He maintains and manages the schedule of increase which must be followed when to and when not to sow and reap. This is a First In, First Out (FIFO) asset-management methodology where the old is just as good as the new.

23 The land shall not be sold for ever: for the land is mine; for ye are strangers and sojourners with me. Reference: Deuteronomy 32:43 KJV

24 And in all the land of your possession ye shall grant a redemption for the land.

Explanation (v.23-24): Within the Jewish Community, there must remain a public asset that is a common foundational resource to all the people such as in agriculture where all the people must be feed and kept well to manifest their skills, talents and experience. This means that the entire Jewish Communities own the land and are subsequent tax payers to the Government.

25 If thy brother be waxen poor, and hath sold away some of his possession, and if any of his kin come to redeem it, then shall he redeem that which his brother sold.

26 And if the man have none to redeem it, and himself be able to redeem it;

27 Then let him count the years of the sale thereof, and restore the overplus unto the man to whom he sold it; that he may return unto his possession.

28 But if he be not able to restore it to him, then that which is sold shall remain in the hand of him that hath bought it until the year of jubilee: and in the jubilee it shall go out, and he shall return unto his possession.

Explanation (v.25-28): If a member of the Jewish Community is poor and destitute he still has public value among his people in that he has the ability to earn money through his productivity, and even if he has passed away, his brethren or next of kin can still redeem that which he has sold. They will also account for the value of that in which he has sold by time of contrasting values. If the deceased has no next of kin or next of kin who refuses to redeem it, his possession shall remain in the hands of him who brought his possession, and on the day of jubilee, his possession will go back into public ownership.

29 And if a man sell a dwelling house in a walled city, then he may redeem it within a whole year after it is sold; within a full year may he redeem it.

30 And if it be not redeemed within the space of a full year, then the house that is in the walled city shall be established for ever to him that bought it throughout his generations: it shall not go out in the jubilee.

31 But the houses of the villages which have no wall round about them shall be counted as the fields of the country: they may be redeemed, and they shall go out in the jubilee.

Explanation (v.29-31): A house within a walled city (or fortified city) has greater value then a house on the open plains, as such, its value is based on the protection it provides the Jewish Community because it can be a location for a major military or administrative center for a region. These walled cities provide a greater opportunity for commerce and trade. Therefore, it helps the Jewish Community expand on its material resources to a greater extent. This allowed for a faster turnover of buying and selling properties within the confines of the jubilee. If the buyer of that house within the walled city at the time of redemption if not redeemed within a year of its purchase, it doesn’t have to go back into public ownership forever.

32 Notwithstanding the cities of the Levites, and the houses of the cities of their possession, may the Levites redeem at any time.

Explanation (v.32): The Leviticus Tribe, the Tribe of Moses and Aaron were under a special provision by God as to provide spiritual leadership to the other eleven tribes. The inheritance of the tribe of Levi was the word of God to educate the Jewish Community where the inheritance of the other eleven tribes was in land and substance. The other tribes was to provide for the necessity and wants of the Leviticus Priest Hood, where the Levites were to almost exclusively focus on God’s word. Therefore, under this special provision, commerce activity for the Levites is then more active in the exchange of goods and services.

33 And if a man purchase of the Levites, then the house that was sold, and the city of his possession, shall go out in the year of jubilee: for the houses of the cities of the Levites are their possession among the children of Israel.

34 But the field of the suburbs of their cities may not be sold; for it is their perpetual possession. Reference: Acts 4:36-37 KJV

Explanation (v.33-34): If any of the eleven tribes of the Jewish Community purchase a house anywhere within the walled cities of Israel, then it shall be redeemed back to the Leviticus Tribe along with a house he owns of equal value at the time of jubilee since the buyer can own but not take possession of this Levite house. Therefore, land outside of the walled cities of the Levites can never be redeemed because it is under perpetual ownership by all of the Jewish Community.

35 And if thy brother be waxen poor, and fallen in decay with thee; then thou shalt relieve him: yea, though he be a stranger, or a sojourner; that he may live with thee.

36 Take thou no usury of him, or increase: but fear thy God; that thy brother may live with thee. Reference: Exodus 22:25; Deuteronomy 23:19 KJV

37 Thou shalt not give him thy money upon usury, nor lend him thy victuals for increase.

38 I am the LORD your God, which brought you forth out of the land of Egypt, to give you the land of Canaan, and to be your God. Reference: Leviticus 22:32-33 KJV

39 And if thy brother that dwelleth by thee be waxen poor, and be sold unto thee; thou shalt not compel him to serve as a bondservant:

40 But as an hired servant, and as a sojourner, he shall be with thee, and shall serve thee unto the year of jubilee:

41 And then shall he depart from thee, both he and his children with him, and shall return unto his own family, and unto the possession of his fathers shall he return. Reference: Exodus 21:3 KJV

Explanation (v.35-41): Nevertheless, since the term brother applies to a stranger or sojourner where he is a non-Jewish National, he must be given full consideration in the operation of the jubilee, and the Jewish Community must not compel him to take less value in such as he should receive as he sold originally. Subsequently, don’t loan him any assets for the purpose of increasing his return on investment. This methodology is retained through obedience and unity. For the consideration of that individual that is poor and destitute, he must be given full rights under the Leviticus Law as a citizen with complete commercial privileges and equality in employment value towards the jubilee. Therefore, the stranger or sojourner can be potentially employed for fifty years and after the completion of his contract with the employer can return home his family.

42 For they are my servants, which I brought forth out of the land of Egypt: they shall not be sold as bondmen.

43 Thou shalt not rule over him with rigour; but shalt fear thy God.

Reference: Ephesians 6:9; Exodus 1:13-17 KJV

44 Both thy bondmen, and thy bondmaids, which thou shalt have, shall be of the heathen that are round about you; of them shall ye buy bondmen and bondmaids.

45 Moreover of the children of the strangers that do sojourn among you, of them shall ye buy, and of their families that are with you, which they begat in your land: and they shall be your possession.

46 And ye shall take them as an inheritance for your children after you, to inherit them for a possession; they shall be your bondmen for ever: but over your brethren the children of Israel, ye shall not rule one over another with rigour.

Explanation (v.42-46): When the children of Israel left out of Egypt, along with them came a group known as the mixed-multitude known as strangers or sojourners in the land. Under the leadership of Moses, he extended to them all Jewish Community rights and privileges. When the scriptures speaks of buying (i.e. shalt have) bondsman and bondmaids, it is an indication of hiring. Now, both Jews and Gentiles under God’s direction become an economic resource one to the other. Therefore, under this process of employer employee relationship, the Jewish Community will follow this methodology for its future generations. Moreover, this methodology must never be applied to brethren of the Jewish Community.

47 And if a sojourner or stranger wax rich by thee, and thy brother that dwelleth by him wax poor, and sell himself unto the stranger or sojourner by thee, or to the stock of the stranger's family:

48 After that he is sold he may be redeemed again; one of his brethren may redeem him: Reference: Nehemiah 5:5 KJV

49 Both thy bondmen, and thy bondmaids, which thou shalt have, shall be of the heathen that are round about you; of them shall ye buy bondmen and bondmaids.

Explanation (v.47-49): Because of the equity and fairness of the employer employee relationship, there will become many strangers and sojourners who will become wealthy. If it becomes that an individual of the Jewish Community becomes wax poor wherein the employer becomes the employee to the stranger, sojourner or their families, then his Jewish brethren can redeem him at the time of the jubilee. Redemption can be done by an Uncle, Cousin or next of kin in proper order. Also, the Jewish individual can redeem himself if he is able.

50 And he shall reckon with him that bought him from the year that he was sold to him unto the year of jubilee: and the price of his sale shall be according unto the number of years, according to the time of an hired servant shall it be with him.

Reference: Job 7:1; Isaiah 16:14 KJV

51 If there be yet many years behind, according unto them he shall give again the price of his redemption out of the money that he was bought for.

52 And if there remain but few years unto the year of jubilee, then he shall count with him, and according unto his years shall he give him again the price of his redemption.

53 And as a yearly hired servant shall he be with him: and the other shall not rule with rigour over him in thy sight.

54 And if he be not redeemed in these years, then he shall go out in the year of jubilee, both he, and his children with him.

55 For unto me the children of Israel are servants; they are my servants whom I brought forth out of the land of Egypt: I am the LORD your God.

Explanation (v.50-55): Due to the reversal of the employer employee contractual agreement in favor of the heathen, the process that worked for the heathen is now applied to the Jewish individual. This will keep an economic balance amongst both Jew and Gentile as a means of tax contributions at the time of the jubilee no matter how long or short the sabbatical year would be until the time of jubilee. The Jewish and Gentile individuals working together to balance the books will always show transparency in amounts retained and given. The beauty of the jubilee period for the Gentiles that are unable to redeem themselves, still have their freedom, self-determination and God’s help since they can leave the Jewish Community if they wish.

SUMMARY OF THE FIFTIETH YEAR CALLED JUBILEE:

- The Source Or Origin Of Name: The name jubilee is derived from the Hebrew jobel, the "joyful shout or clangor of trumpets", by which the year of jubilee was announced as directed by God.

- The Time Of Its Celebration: It was celebrated every fiftieth year, marking the half century; so that it followed the seventh sabbatical year, and for two years in succession the land lay fallow. It was announced by the blowing of trumpets on the Day of Atonement (about the 1st of October) the tenth day of the seventh month of the Israelites' civil year.

- The Laws Connected With The Jubilee: These embrace three points;

- Rest for the soil (Leviticus 25:11-12). The land was to lie fallow, and there was to be no tillage as on the ordinary sabbatical year. The land was not to be sown, nor the vineyards and oliveyards dressed; and neither the spontaneous fruits of the soil nor the produce of the vine and olive was to be gathered, but all was to be left for the poor, the slave, the stranger and the cattle (Exodus 23:10-11). The law was accompanied by a promise of treble fertility in the sixth year, the fruit of which was to be eaten till the harvest sown in the eighth year was reaped in the ninth (9th) (Leviticus 25:20-22). But the people were not debarred from other sources of subsistence, nor was the year to be spent in idleness. They could fish and hunt, take care of their bees and flocks, repair their buildings and furniture, and manufacture their clothing.

- Reversion of landed property. The Israelites had a portion of land divided to each family by lot. This portion of the Promised Land they held of God, and were not to dispose of it as their property in fee‐simple. Hence no Israelite could part with his landed estate but for a term of years only. When the jubilee arrived, it again reverted to the original owners. This applied to fields and houses in the country and to houses of the Levites in walled cities; but other houses in such cities, if not redeemed within a year from their sale, remained the perpetual property of the buyer. The Levites major inheritance unlike the other 11 tribes was in the word of God.

- The structure of the Jewish Community and the Gentiles was now a free society. Those Israelites who had been slaves under Egyptian Law now had self-determination. Apparently this periodic emancipation applied to every class of Hebrew and Servants to him who had been sold under taskmasters in Egypt and all were in poverty. They were dependent on the Egyptian economy for their livelihood as slaves. The Jews and Mixed-Multitude had no rights, freedoms and self-determination to conduct their lies as individuals, groups and a nation.

- The Reasons For The Institution Of The Jubilee: It was to be a remedy for those evils which sometimes accompany human society and human government; and had these laws been observed, they would have made the Jewish nation the most prosperous and perfect that ever existed over all economic systems.

- The jubilee tended to abolish poverty and suffering. It prevented large and permanent accumulations of wealth through equity in tax obligations. It gave unfortunate families an opportunity to begin over again with a fair start in life. It particularly favored the poor, without injustice to the rich.

- It tended to abolish slavery, and in fact did abolish it; and it greatly mitigated it while it existed. The effect of this law was at once to lift from the heart the terrible incubus of a life‐long bondage-that sense of a hopeless doom which knows no relief till death.

- As an agricultural people, they would have much leisure; they would observe the sabbatical spirit of the year by using its leisure for the instruction of their families in the law, and for acts of devotion; and in accordance with this there was a solemn reading of the law to the people assembled at the feast of tabernacles.

- This law of knowledge, by which the right heir could never be excluded, was a provision of great wisdom for preserving families and tribes perfectly distinct, and their genealogies faithfully recorded, in order that all might have evidence to establish their right to the ancestral property. Hence the tribe and family of Christ were readily discovered at his birth.

- Mode Of Celebration: The Bible directs on how the Jewish Community should conduct the jubilee celebration. It was to be proclaimed by trumpets, and that it was to be a sabbatical year. Tradition tells us that the Levites blew nine blasts, so as to make the trumpet literally 'sound throughout the land, ' and that from the feast of trumpets or new year till the Day of Atonement, they ate, drank and rejoiced in praise of the Gods goodness.

To Study & Learn About The Details Of Our Affiliate Crowdfunding Program's Important Plan & Strategy, Purchase Our E-Book Guide Today By Clicking On The 3D Image Below To Make A PayPal Transaction:

In order to obtain Bitcoin (BTC) from More Credit Card Services (MCCS), you must follow the detailed instructions inside our Affiliate Crowdfunding E-Book Guide, and then come back to this Online E-Book Guide to click-on the Bitcoin Icon shown below:

If you decide to purchase our E-Book Guide via PayPal, be sure to [click-here] and register for an MCCS Account so we can add you in as a lifetime affiliate member!

========================================================

========================================================

Roadmap For Fixing Your Credit & Debit Status

One of the most common questions we receive at More Credit Card Services (MCCS) is: Will your company help me with advice towards repairing my credit and debt issues? And the answer to this question is an unequivocal and resounding YES because we make suggestions from Angel Investment experience while helping you navigate your personal needs towards crowdfunding success which does not involve General E-Trading.

With the advent of our Affiliate Crowdfunding Program, you no longer need to be the next great social network to raise money from professional investors. Our firms startups cover a broad spectrum of individuals such as the working class, unemployed and inlcuding any or all viable business industries. More importantly, our investors (e.g. affiliate members) are willing and excited to invest across that spectrum of entities in a dissimilar but joint venture capacity towards crowdfunding success.

Hence, because our firm More Credit Card Services (MCCS) had been networking with Byran Emerson's financial company named Starlight Investment since January of 2010 in an investment capitalization program for entrepreneurs and founders, our unity between us has translated our background, knowledge and experience to help other startups achieve their goals and objectives especially in this poor financial climate. However, you should check your credit score rating before you investigate financial opportunities.

How To Repair Your Credit Report, Improve Your FICO Scores And Make Your Money Work For You!

Don't Be Boring! Be Exciting! (Emaze!): It's important to note that repairing bad credit is a bit like solving math problems. It takes time and there is no quick way to fix a credit score. In fact, out of all of the ways to improve a credit score, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast. In general, the best advice for rebuilding credit is to manage it responsibly overtime. If you haven't done that, then you need to repair your credit history before you see credit score improvement. For your conveinence, the following tips below will help you do that and are divided up into four (4) categories based on the data used to calculate your credit score. For more information about the data used to find what's in your credit score [click-here].

Four (4) Important Things You Can Do Right Now:

- Check Your Credit Report - All credit score repairing begins with an analysis of your credit report. If you haven't already, [click-here] and request for a free copy of your credit report and check it for errors. Your credit report contains the data used to calculate your score and it may contain errors. In particular, check to make sure that there are no late payments incorrectly listed for any of your accounts and that the amounts owed for each of your open accounts is correct. If you find errors on any of your reports, dispute them with the credit bureau and reporting agency. Make sure you keep a record of all contacts made in your correction efforts.

- Setup Payment Reminders - Making your credit payments on time is one of the biggest contributing factors to your credit score. Some banks offer payment reminders through their online banking portals that can send you an email or text message reminding you when a payment is due. You could also consider enrolling in automatic payments through your credit card and loan providers to have payments automatically debited from your bank account, but this only makes the minimum payment on your credit cards and does not help instill a sense of money management. For additional information on disputing any inaccurate errors on your personal credit report, [click-here].

- Reduce The Amount Of Debt You Owe - This is easier said than done, but reducing the amount that you owe is going to be a far more satisfying achievement than improving your credit score. The first thing you need to do is stop using your credit cards. Use your credit report to make a list of all of your accounts and then go online or check recent statements to determine how much you owe on each account and what interest rate they are charging you. Come up with a payment plan that puts most of your available budget for debt payments towards the highest interest cards first, while maintaining minimum payments on your other accounts.

- Viable Services That Fixes Your Credit Score - If you don't have the time or effort to accomplished any of the first three (3) tips above, you can go and utilize a company service called Total Credit Awareness (TCA) from Dr. Michael Grayson which helps individuals and businesses improve their credit score and eliminate debt [click-here]. Also watch his interview on the Rock Newman Show discussing the issues plaguing the black community from becoming home owners because of bad credit and being caught up into debt [click-here]. If you can't afford the cost of Dr. Michael Grayson's services going towards fixing your credit score and eliminating debt, you can join us today to become an affiliate member and utilize our Affiliate Crowdfunding Program for raising the capital you need to do it.

Five (5) Additional Tips On How To Fix A Credit Score & Maintain Good Credit:

- Payment History Advice: Contributing 35% to your score calculation, this category has the greatest effect on improving your score, but past problems like missed or late payments are not easily fixed.

- Pay your bills on time: Delinquent payments, even if only a few days late, and collections can have a major negative impact on your FICO Scores.

- If you have missed payments, get current and stay current: The longer you pay your bills on time after being late, the more your FICO Scores should increase. Older credit problems count for less, so poor credit performance won't haunt you forever. The impact of past credit problems on your FICO Scores fades as time passes and as recent good payment patterns show up on your credit report. And good FICO Scores weigh any credit problems against the positive information that says you're managing your credit well.

- Be aware that paying off a collection account will not remove it from your credit report: It will stay on your report for seven years.

- If you are having trouble making ends meet, contact your creditors or see a legitimate credit counselor: This won't rebuild your credit score immediately, but if you can begin to manage your credit and pay on time, your score should increase over time. And seeking assistance from a credit counseling service will not hurt your FICO Scores.

- Amounts Owed Advice: This category contributes 30% to your score's calculation and can be easier to clean up than payment history, but that requires financial discipline and understanding the tips below.

- Keep balances low on credit cards and other revolving credit:

High outstanding debt can affect a credit score. - Pay off debt rather than moving it around: The most effective way to improve your credit score in this area is by paying down your revolving (e.g. credit cards) debt. In fact, owing the same amount but having fewer open accounts may drastically lower your score.

- Don't close unused credit cards as a short-term strategy to raise your score.

- Don't open a number of new credit cards that you don't need, just to increase your available credit: This dangerous approach could backfire and actually lower your personal credit score.

- Keep balances low on credit cards and other revolving credit:

- Length Of Credit History Advice:

- If you have been managing credit for a short period of time, don't open a lot of new accounts too rapidly: New accounts will lower your average account age, which will have a greater effect on your credit score if you don't have additional credit information. Furthermore, rapid account buildups can look very risky if you are a new credit user.

- New Credit Advice:

- Do your rate shopping for a given loan within a focused period of time:

FICO Scores can distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which inquiries occur. - Re-establish your credit history if you have had problems: Opening new accounts responsibly and paying them off on a timely basis will result towards raising your credit score in the long term.

- Note that it's OK to request and check your own credit report: This won't affect your personal credit score, as long as you order your credit report directly from the credit reporting agency or through an organization authorized to provide credit reports to consumers.

- Do your rate shopping for a given loan within a focused period of time:

- Types Of Credit Use Advice:

- Apply for and open new credit accounts only as needed: Don't open accounts just to have a better credit mix - it probably won't raise your credit score.

- Have credit cards - but manage them responsibly: In general, having credit cards and installment loans (and paying timely payments) will rebuild your credit score. Someone with no credit cards, for example, tends to be higher risk than someone who has managed credit cards responsibly.

- Note that closing an account doesn't make it go away: A closed account will still show up on your credit report, and may be considered by the score.

To summarize this, fixing a credit score is more about fixing all errors in your credit history (if they happen to exist) and then following the guidelines above to maintain a consistently good credit history. Raising your score after a poor mark on your report or building your credit for the first time will take patience and discipline.

Keeping Up With Your Credit Report:

Inaccurate And Damaging Information Can Also Be Removed From Your Credit Report. (KNOWING WHERE YOU STAND CAN SAVE YOU TIME AND MONEY):

Many people put off checking their credit status until a need arises -- such as applying for a loan or a line of credit. But it's important to check your credit on a regular basis to ensure that there aren't any errors, and to help protect yourself against fraud plus identity theft.

Issues such as these could prevent you from receiving a loan when you need it... or getting your best possible rate for financing. Proactively checking your credit could save you the time and money it takes to correct these problems.

-

How often should you check your credit report?

Many experts recommend that you check your credit at least once per year, but you can do it as often as you like. If you opt for an annual check, try scheduling it after an event such as your birthday or a holiday, to make it easy to remember.

Additionally, there are different credit rating agencies; the three major reporters are Equifax, Experian and TransUnion. When checking your personal credit report, you can choose to pull all three reports at once...... or you can space them out evenly throughout the year.

-

You might be wondering can I check my credit report for free?

The answer is yes. Each year, you're entitled to one free credit reporting from each of the three major credit reporting agencies mentioned above. All you have to do is visit AnnualCreditReport.com to request a free copy.

You have the option to view your credit report online or have a copy mailed to you. But keep in mind, the free credit report you receive contains only the information on file with the credit bureaus, not your actual credit score. In most cases, you would need to pay a fee to get your exact score.

If you'd like to check your credit report more often, a credit monitoring service is one way to do more-frequent credit checks. Depending on the service, you would usually pay a fee to receive updated reports on a monthly or quarterly basis.

-

Once you receive your credit report, how do you know what to look for?

To start this important analysis, you should make sure everything on the report is accurate by answering the following quesitons below:

- Do you recognize the accounts?

- Does the report accurately reflect your payment history on each of the accounts?